Buying a new car doesn’t need to be complicated. Yet the process can be time-consuming and, at times, frustrating.

In pandemic times, it’s even more difficult because inventories remain low, prices are high, and car buyers don’t have much room for price negotiation.

Use our comprehensive list of steps to purchase a new vehicle to save you time and ease your mind during the process.

10 Steps to Buying a New Car

When buying a new car, you’ll want to know everything from your shopping style to what you can afford. Here are the steps.

- Know Your Shopping Style

- Narrow Down your Shopping List

- Calculate a Price You Can Afford

- Do Your Research

- Know When the Price is Right

- Leasing vs. Buying

- Find Financing, Warranties, and Insurance

- Sell or Trade Your Current Vehicle

- Consider Your Buying Options

- Get the Most Out of Your Test Drive

1. Know Your Shopping Style

Even with so much automotive information available on the internet, many people still want to purchase new cars within only a few days of deciding to buy. This means a shopper could buy the wrong vehicle or one with too few or more features than needed rather than making an informed purchase decision.

Remember, as the buyer, you need to be the one in control throughout the entire process. It’s best to make choices along the way before you even step into a dealership. With so much reliable information available, even if you already have a strong preference for the vehicle you want, you may be pleasantly surprised by the outcome if you take some time to research and remain open-minded.

Here’s one way to start: Take a look at the following list of different types of shoppers and decide which one best describes you. After that, begin your vehicle search using one of the convenient shortcuts shown below, or simply follow all 10 Steps to Buying a New Car to cover all the bases.

Value Shopper

You want a reasonable price, but you are willing to pay for quality.

Short Cut: Check out J.D. Power quality ratings on the vehicles you like.

Image Shopper

You get concerned with what your vehicle says about you. Does it project a desirable image?

Short Cut: Go straight to the vehicle makes and models you prefer and check reviews.

Methodical Shopper

You enjoy the chase as much as the conquest and cover every base, becoming somewhat of a new car expert.

Short Cut: You’ll need to go through the entire “10 Steps to Buying a New Car” process.

Safety-Conscious Shopper

You want a safe and reliable vehicle you can trust to keep you and your family safe on the road.

Short Cut: Read about the United States Department of Transportation’s National Highway Traffic Safety Administration’s 5-Star Safety rating system.

Whatever your shopping style, the information you gather and the effort you put into the process will serve you well and help you avoid the buyer’s remorse that often accompanies automotive purchases.

2. Narrow Down Your Shopping List

Let Your New Car Find You

How do you narrow down your list with hundreds of new makes and models? To some extent, your lifestyle can help.

Imagine the activities you’ll experience in your new vehicle. If you have small children, you need a car with the best safety features and a roomy vehicle with ample cargo space for all the goods you usually carry. Or perhaps you care more about performance or style. Or maybe you have a job in sales and need something suitable for taking clients to lunch. If your perfect vehicle needs to haul or tow something, you will narrow your choices to those.

When considering the purchase of a car, everything counts like number of seats, number of doors, size, performance, color, style, comfort, and sometimes even towing capacity. The key is to narrow your search by creating a short list of choices before going to the dealership.

Where to start? Begin researching online and check out reviews and guides that can help you narrow your list of candidates in a short time.

Side-By-Side Comparisons

Another tool that will help you narrow your search is the Side-By-Side Comparison, which allows you to compare specifications and see which features are standard or optional on each new car. This is a beneficial exercise when you are down to just a few vehicles and want to compare finer points or features.

These easy-to-use internet tools put you in a position to analyze your choices before making your final decision effortlessly. Avoid making the common mistake of impulse buying. A minor delay in automotive gratification is worth the time spent, especially when receiving that information from a trusted source.

3. Calculate a Price You Can Afford

Let Your Budget Do the Driving

When considering a new vehicle purchase, the lines of affordability can quickly become blurred due to the varied financing options available. Wise buyers shop for a new vehicle based on what they can afford. Keep an open mind, and you could be pleasantly surprised by the list of cars within your price range.

Affordability is a multi-faceted issue because the car-buying process can consist of several financial considerations. It will help if you accurately determine what your current car is worth, how much of a down payment you can make, and a reasonable amount you can handle for monthly payments. Some careful thought and brutal honesty will pay enormous benefits later.

Many personal finance experts recommend keeping your car budget costs to no more than 10% of your take-home pay after taxes. Your budget will include any car payment, auto insurance, gas, maintenance, and repairs. Use our tool to see what it will cost over five years for the vehicle make and model you prefer. This tool provides estimates for gas, insurance, repairs, and more. It can help you determine your overall budget.

Far too many car buyers shop for vehicles beyond their means and prefer a low down payment. It can lead buyers to drastically misjudge their capabilities regarding monthly payments and then want to reduce the monthly payments by stretching out the lengths of the loans, all of which lead to trouble in the future.

Another crucial element is deciding what to do with your current car. Generally, your vehicle may be worth more when you sell a used car yourself to a private party rather than trade it in. But many people don’t want to take the time and make an effort to do that. Understand that if you trade it in, you will probably not get as much for it as if you sell it yourself.

The biggest issue for most buyers is the price of the new car. Fortunately, determining the MSRP (manufacturer’s suggested retail price) is easy, and figuring at least a range for a realistic transaction price is also not complicated.

RELATED – When Will Car Prices Drop?

Calculating Affordability

The new-car buying process is greatly simplified when you discover the bottom line vehicle price you can afford ahead of time.

This is true whether you lease or buy. Here’s an example of the kinds of details you could encounter in a typical new car deal:

- “The vehicle I currently own has a trade-in value of $12,500.”

- “I owe $2,000 on it.” Meaning you have about $10,500 equity in the car.

- “I’ve got $2,000 in savings I want to use as a down payment.” You’ll spend $12,500 with the trade.

- “I want to keep my payments under $500 per month for 60 months.” That monthly payment schedule will allow you to purchase a $37,000 vehicle and finance, roughly about $30,000, due to taxes and interest once you put the down payment on the car. This example assumes a 10% tax rate, or $2,715, and a 4% new car loan interest rate, or $2,850.

Many online tools can help you determine affordability, including a car affordability calculator from our sister site Autotrader.

Your Current Vehicle: Trade It In or Sell It Yourself?

If your car is in excellent condition and you have impeccable service records, it may be well worth your while to sell it on your own. On the other hand, if your car needs a lot of work, you may put more money into it than you can recover — so take a realistic look before deciding.

Get the Kelley Blue Book® Trade-in Value of your current vehicle. Based on the condition of your car, the value represents an accurate range of what you can expect when trading in your car at a dealership. If you decide to trade your vehicle, keep in mind, the dealer must assume the responsibility for preparing your trade-in for resale. This process usually includes mechanical and smog inspections and repairs to make the car ready to sell to the next owner. This will cost the dealer money, and the dealer will figure this into the deal.

If you prefer to sell your vehicle to a private party, check out the Blue Book® Private Party value first. This is the value you can expect to get when selling the car to another consumer. In this case, you are solely responsible for preparing your vehicle for sale and setting and negotiating a fair price. Read more on trading in or selling yourself in Step 8.

Loan Amount

Calculate the monthly payment you can afford via Autotrader’s car payment calculator to determine the amount you need to borrow. This tool factors in the interest rate and the term of your loan. Now add your available cash from a down payment and a car you trade with the loan amount (if you have one), and you’ll begin to arrive at a price that works best for you.

Also, check for any available customer or dealer incentives on your new vehicle, adding to your available cash amount. Remember, you still need to add taxes, tag costs, and fees, which can vary by state. You can obtain this information through your local DMV.

New Car Pricing

You can determine new vehicle pricing on Kelley Blue Book, which features three types of new car pricing:

- Invoice Price

The invoice price is the dealer’s cost for the vehicle and its options. It does not include what a dealership pays for advertising, selling, preparing, displaying, or financing the vehicle. See how the invoice price compares to the MSRP on this 2022 Toyota Camry SE. - MSRP Price

The MSRP is the manufacturer’s suggested retail price, also known as the “sticker price.” By law, MSRP must be posted on every new vehicle and is usually — but not always — the highest market price. Exceptions occur when certain vehicles are in high demand or experience low availability (or both, similar to market conditions as of this writing). - Fair Purchase Price Range

Also, check out an available price called Fair Purchase Price. Updated weekly, the experts at Kelley Blue Book have developed the most accurate pricing guidelines for new-car buyers based on purchase data collected across the country.

In addition, incentives may be available on the car of your choice and will bring down the overall price. Read more on new vehicle pricing in Step 5.

Your decision to stick to a budget will help provide peace of mind, both in the car-buying process and future. And remember, you’re paying more than a dollar for every dollar you borrow, so making a substantial down payment toward the purchase price makes long-term sense. With these principles in place, you should be able to begin in-depth research on your new, shorter list of cars.

4. Do Your Research

What makes a new car the best new vehicle for you?

With the incredible amount of data available, what specifically should you research? You’ll likely consider pricing and equipment options, and the following:

- Safety features and ratings

- Ratings for vehicle quality

- The total cost of ownership over period of five years

This information can help you achieve some needed peace of mind. Then, follow up by researching owner opinions and expert reviews.

Safety

There are two aspects of safety. They are passive and active safety. Know the differences of both and learn what’s most important to you.

Passive Safety: This concerns itself primarily with the protection of the occupants in the event of a crash. For the most part, passive safety is the job of the car, although the occupants have the responsibility to use the seat belts.

These are the features associated with passive safety:

- Airbags

- Energy-absorbing crumple zones

- Seat-belt pretensioners

- Head protection devices and the like

Active Safety: This concerns itself primarily with not having the crash in the first place. For the most part, active safety is the driver’s job, but certain essential features on the car can help the driver avoid a crash. Features associated with active safety:

- Antilock brakes

- Traction control

- Stability control

- All-wheel drive or 4-wheel drive (when driving in bad weather or on slippery surfaces)

The relative importance of these features may vary based upon your driving style and where you drive. You can also check the National Highway Traffic Safety Administration’s (NHTSA) 5-Star Safety ratings. These ratings will give you an idea of the relative performance levels of various cars and trucks in crashes and how your prospective vehicle’s safety features compare to others.

RELATED STORIES: 12 Best Family Cars of 2022

Quality

An online analysis of how your favorite vehicles rate in quality can be a true eye-opener. Years ago, quality referred only to the absence of defects in a car. But research organizations like J.D. Power and Associates have expanded their research analysis to cover positive aspects of new cars.

This valuable information is provided in the form of J.D. Power Circle Ratings. On the absence-of-defects side, sometimes described as “things gone wrong,” you can find out how the car rates for mechanical, feature, and accessory quality and the body and interior quality. For positive aspects of quality, known as “things gone right,” you’ll find ratings for performance, creature comforts, and style. There’s also a score for the dealership experience based on the J. D. Power “Customer Service Index.”

Expert Opinions

Another way to gain confidence in your purchase is to read what the experts say about your new vehicle. Reading the opinion of experts before the test drive serves many purposes. You can discover the strengths of the car’s performance, see how the car compares in its class, and learn how the vehicle rides and performs on longer trips or what it’s like to drive around town. See our reviews for the car you hope to purchase.

Owner Opinions

Check out owner opinions. Those can be a valuable resource to discover how current drivers rate their new cars. After purchasing your vehicle, you can submit a review to help others make informed decisions.

Side-By-Side Comparisons

Finally, don’t forget to run a side-by-side comparison of the vehicles you are considering, and you will get another level of insight. Seeing horsepower, mileage, seating capacity, headroom, legroom, and other specifications side-by-side helps you quickly identify which vehicles meet your specific needs.

5. Know When the Price is Right

Once you know the car you want and select the model, options, and color, it’s time to get serious about the price. One key to success in negotiating for a new vehicle is collecting as much information as possible before making the deal.

Today’s savvy car buyer has the internet to thank for helping to take some of the mystery out of vehicle pricing. The online community has provided plenty of fast, free, and factual information. Values include the invoice, MSRP, and Fair Purchase pricing.

Invoice Price

Knowing the dealer’s invoice price helps you determine the lowest price a dealer can go and still make a gross profit on the sale. Dealer invoice is the dealer’s cost for the vehicle only and doesn’t include any of the dealer’s costs for advertising, selling, preparing, displaying, or financing the vehicle.

It’s a great bargaining tool when not in a tight market for car inventory. However, it does not always tell the entire story. Incentives and manufacturer-to-dealer cash could reduce the price below the invoice in some cases. The average dealer markup over invoice cost on most high-volume vehicles is less than 10%. Compare this to any other industry, and it’s low. Dealers don’t make a lot of money on new cars, so they negotiate less on new car prices than used cars. Dealers make most of their money on used cars, parts, and service.

MSRP

The MSRP, or manufacturer’s suggested retail price, gets set by the manufacturer and means just what it implies — a suggested price. By law, every vehicle sold in America displays this price.

So who pays the MSRP? Lately, the lack of vehicle inventory due to the microchip shortage means demand is higher than supply. For instance, during their respective launches at the time, the Mazda Miata, Volkswagen Beetle, Chrysler PT Cruiser, and Honda Odyssey demanded prices well above MSRP.

Unlike most other business categories, the automotive industry gives retailers the ability to offer customers a discount while still making a profit.

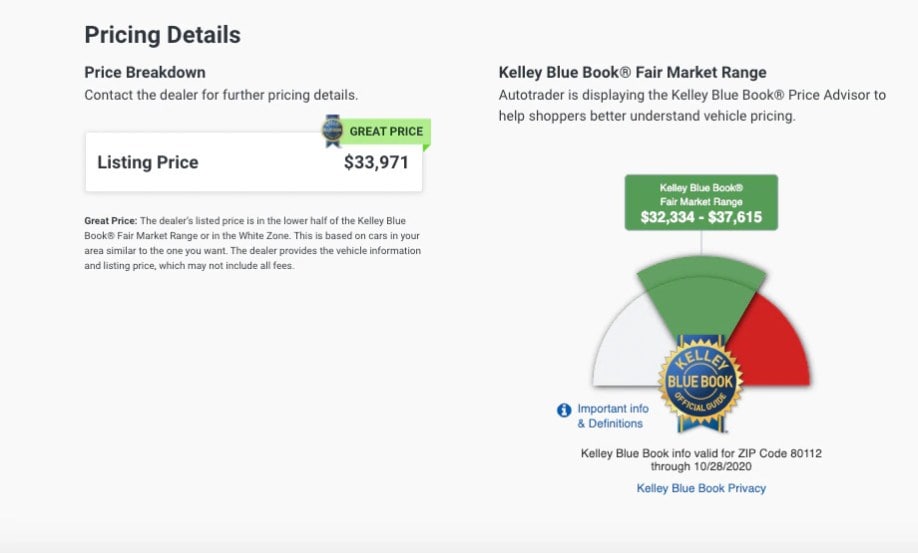

Fair Purchase Price

The Fair Purchase Price is the industry’s most reliable new vehicle pricing tool. It gets updated weekly. The price you receive online specifically reflects the price consumers are paying for new vehicles on a current market basis. Down to the specific make and model, these pricing reports offer a new car’s typical selling price, its typical range of selling prices, and the market conditions affecting those sales.

The Fair Purchase Price is not a number influenced by dealers or manufacturers — it is actual transaction data representing a range of what people paid for specific vehicles. This pricing knowledge will benefit you greatly as you decide what you are comfortable spending for your next car.

RELATED STORIES: Subaru Nicely Asks Dealers to Stop Markups

Optional Equipment

The price of your next car will depend greatly on the options you desire. Trends in the industry have moved toward car manufacturers putting packages together rather than simply including options as separate add-ons.

This makes pricing those vehicles much easier. For example, the popular Honda Civic sedan comes in separate versions like the LX, Sport, EX, and Touring.

To remain competitive with the high-volume best sellers, many manufacturers offer standard equipment packages such as the Honda Sensing Safety suite of driver assistance technologies on all models, from automatic braking to adaptive cruise control. As you increase the price, more features become available on each model type. For example, the Honda Civic Touring offers additional safety features like its Blind Spot Information System and parking sensors.

The most efficient way to discover how optional equipment will affect the bottom line is to build a car online. This handy tool will automatically add the cost of each option available on your vehicle and give you a new total reflecting the additional cost factors.

RELATED STORIES: Ordering a Car From the Factory: Everything You Need to Know

The Market Drives the Deal

You can count on car prices fluctuating as popularity, supply, and other factors change. In other words, if you are buying a popular car in short supply, when it first comes to market, you can expect to pay more.

Other people would never dream of paying a premium for anything. For the true bargain-hunter, use our helpful car buying tips that might position you to get the deal you want.

Options that may get you discounts to buy:

- Out-of-season vehicles, such as a convertible in cold weather or the winter season.

- Late-model vehicles: in the year before a body-style change.

- Overstocks or mass-market vehicles come with a customer cash incentive that can be higher in the summer and winter months.

- Deal-making on the last day of the month happens because dealers have monthly sales quotas.

- End-of-the-year deals at some dealerships could be available as they clear out inventory for tax reasons.

The research you’ve done so far will give you a comfort level on the right price of your next vehicle. A knowledgeable and reputable dealer will be able to negotiate a fair deal with you and try its best to convert you into a loyal return customer. Today, all you need when you get to the dealership is fundamental information to confidently transact your new car purchase. Read more on finding a dealer in Step 9.

6. Leasing vs. Buying

With rising car prices, creative financing has come to the forefront, tempting us with promises of longer loan terms to lower our payments. Some dealers may still offer zero or minimal down payments and low monthly payments. However, in all finance scenarios, some sort of fee is attached. The question then becomes, which financial approach best meets your needs?

Leasing

Lower monthly payments and little to no money down can make car leasing seem like a great deal. The truth is that leasing offers convenience, but only if you are willing to put up with restrictions.

Leasing restrictions include mileage limits of typically 12,000 miles per year, or sometimes 10,000 miles per year, diligent upkeep and care of the vehicle, and, in some cases, penalties for early termination.

After a lease deal is offered to you, be sure to pay close attention to the negotiated purchase price of the vehicle. In addition, look for any fees outside the lease rate, and never sign a lease contract unless the residual value or optional purchase price at the end of the lease is clearly shown.

You are a good candidate for leasing if you prefer to have a new car every few years and put limited miles on your car. Another perk for some is when you can write off your car lease as a business expense. If you want a lease simply to reduce the amount of your monthly payment, consider that it may be outside your realistic capability to make the payments. Try to give serious thought to selecting a less-expensive vehicle, if that’s the case.

RELATED STORIES: Car Leasing Guide: Everything You Need to Know

Buying

Before considering the purchase of a new car, it is wise to establish the amount you are willing to spend or calculate the monthly loan payment. Don’t forget that, after negotiating the car’s final price, you will need extra cash to cover the tax, title, and registration.

Next up, arrange your financing. You may obtain a loan with the dealership or manufacturer’s financing. But there are options. You can arrange for pre-approval of a loan from your bank or credit union. When you do some of these things, you may not have a specific vehicle in mind, just a general price range, and when you make the deal, you write the dealership a check for the total amount.

Some institutions will give you a lower interest rate if you choose electronic loan payment, so be sure to ask about it. Read more about financing in Step 7.

Remember to check for incentives on your vehicle of choice. From 0% financing to customer-cash rebates, manufacturers constantly compete for your business by making their vehicles and financing more affordable.

RELATED STORIES: Car Discounts Not Coming Back, Says Largest Dealership Group

Quick Glance Lease vs. Buy

| STEPS | LEASE | BUY |

| Negotiate Price | Yes | Yes |

| Mileage Limits | Yes | No |

| Down Payment | Typically | Yes |

| Purchase Price/Lease Initial Value Taxable* | No | Yes |

| Monthly Payment taxable* | Yes | No |

| Higher Insurance Coverage Required | Yes | No |

| Can Modify the Vehicle | No | Yes |

| Own at End of Term | No | Yes |

* varies state by state

7. Find Financing, Warranties, and Insurance

Financing Your Vehicle

With the buzz surrounding 0% financing deals, you may have the urge to rush to your dealership to apply for that terrific interest-free loan. Unfortunately, you may find that, along with roughly two-thirds of all other consumers, you may not have a sufficient credit rating that will qualify you for the loan or the offer. The alternative will be a different loan at a higher interest rate. At that point, the excitement of driving off the lot immediately may tempt you to take that higher interest rate in exchange for that shiny new car. It’s best to resist that temptation.

Additionally, a credit rating far below-par indicates a person who has had difficulty making payments in the past. That increased risk to the lender is reflected in the higher interest rate to the borrower. Remember, it’s always wise to shop for the lowest interest car loan before making the deal. On Kelley Blue Book, it’s easy to shop for a loan online. But if your credit rating is not good, it’s not wise to shop for a new car in the first place.

If your credit rating looks good, be sure to check the financial incentives from the manufacturer. But be aware that many interest-free financing offers may require shorter terms, which will result in higher monthly payments.

As tempting as a dealer’s discount financing may seem, don’t overlook other deals. You won’t face the same obstacles when you walk onto the lot with financing in place because you’ve done your legwork in advance. And since there’s no obligation until you buy the car, you can assess your purchasing options against the dealer’s best offer.

Visit the finance section to learn more about smart financing.

Even if interest rates rise, they’re still historically low. So, investigate the array of interest rates, incentive options, and the competitive advantage of online financing. You have more tools than ever at your disposal to make a smart vehicle purchase.

Warranties

An extended warranty or service contract will be offered to you when buying your next car. An extended service contract backed by an auto manufacturer is usually your safest bet if you plan to own the car for a long time. These contracts encompass a wide range of repairs and services. The repairs can be done at any authorized dealership and tend to be approved without a hitch. You won’t pay a penny for approved repairs unless your contract includes a deductible.

An extended warranty from an independent company could cost less than an extended service contract from a manufacturer. But the quality of this kind of contract varies widely from company to company. Shop carefully and only consider if you plan to keep your vehicle past its existing warranties.

Insurance Rates

The truth is, automobile insurance is a necessity. Most states, except New Hampshire and Virginia, require all vehicle owners to carry car insurance and be able to show proof of it.

The type of vehicle you choose and the history of your driving record can profoundly affect the cost of insurance. Typically, sports cars, high-performance cars, turbocharged or supercharged vehicles, those with larger engines, and vehicles with 4-wheel drive often result in higher insurance rates. Also, vehicles with histories of being stolen can demand a premium.

Since it always pays to shop around, check rates with your insurance company before buying your new vehicle.

These additional expenses may be unavoidable and should be reviewed carefully before making your next car purchase. As a result, you could save yourself a lot of money and aggravation in the years ahead.

RELATED STORIES: How to Estimate Car Insurance Costs Before Buying

8. Sell or Trade Your Current Vehicle

Like most do-it-yourself projects, selling your own vehicle to a private party can be cost-effective. In contrast, trading in your current vehicle at the dealership makes it easier and sometimes faster.

Before buying your next vehicle, consider the pros and cons of what to do with your current vehicle and make an informed choice.

Trading in Your Vehicle: The Pros and Cons

Trading your car in at the dealership may be quick and easy, but it may not always be painless. The upside of trading is that the dealer does all the paperwork. After settling on an acceptable price, all you have to do is sign the vehicle over and be done with it. The price you pay for the convenience of being relieved of your vehicle will likely be less money for you than if you sold it yourself.

Some people expect the dealer to give the full retail value of the vehicle and are often disappointed by the offers presented to them. Such people are being unrealistic. To avoid any surprises, get the Kelley Blue Book® Trade-in value of your vehicle, and the Kelley Blue Book Instant Cash Offer option, which provides a starting point for trading in a vehicle at a dealership.

This number — based on the condition of your vehicle — is a more accurate representation of what you may expect to be offered. Keep in mind that if the dealer is going to re-sell the car, it must assume the responsibility for preparing it for that eventual resale. This process usually includes mechanical and smog inspections, repairs to make the car ready for sale, and typically a warranty on the vehicle for the new owner. The dealer might also sell the car to a wholesaler or at an auction, where dealers buy and sell cars from and to each other to balance their used-vehicle inventories and make them most appropriate for their respective dealerships.

For example, if you want to trade an old, worn-out pickup truck at a high-end import luxury-car dealership, the truck will likely not go into the dealership’s used vehicle inventory. So that truck goes to the auction.

Trading can also help if you owe more on the loan than the car is worth. This is known as being “upside-down.” The dealer can roll the remaining balance of your current vehicle’s loan into the new loan, thus allowing you to trade in your vehicle without having to pay additional cash. While this is not advisable — because it inflates the loan far beyond the new vehicle’s actual value — it is an option for a buyer who wants to get out of the current vehicle. And it will cost that buyer a lot of money.

Selling Your Vehicle Yourself: The Pros and Cons

Selling your car on your own can get you more dollars but requires patience and good judgment. First, you will need to determine a fair asking price. Kelley Blue Book® Private Party value will give you a price, based on the vehicle’s condition, for you to calculate the value of your vehicle in a consumer-to-consumer transaction.

RELATED STORIES: How to Sell a Car: 10 Steps for Success

Be aware you may need to absorb the cost of making the car presentable and passing any required state inspections or emissions tests. And remember, first impressions are important, so always keep the car clean and ready to be shown while it’s available for sale. You also need to factor in what your time is worth. You will need to be available to answer questions and make appointments for people to see the vehicle and take it for test drives.

Another downside to selling your car yourself is that you could be contacted by some unsavory individuals or people you just don’t feel comfortable with. You need to apply good instincts about people and bring strong negotiation skills. If you decide to sell your car yourself, be sure to put everything in writing and request a cashier’s check or a form of electronic payment, like PayPal. Personal checks can bounce, and it’s never wise to carry cash in large quantities.

Generally speaking, points that will enhance the notion of selling the car yourself include:

- Is it a vehicle that’s normally in strong demand anyway?

- Is it unmodified, thus appealing to the greatest number of buyers who, generally, don’t want someone else’s modifications?

- How about the car’s condition? What about pricing — does it seem reasonable?

If you decide to sell your car yourself, these are the best options available to advertise your vehicle to potential buyers:

- Put an ad up for free using a service such as Facebook.

- Place an ad on a paid service, such as Autotrader or Kelley Blue Book.

Consider These Points When Selling Your Car

- Make your car presentable. Give it a wash and wax on the exterior and complete vacuuming of the interior. If you really want to impress potential buyers, take the car to a professional detailer and get the interior, exterior, and engine thoroughly cleaned.

- Locate all service records. Bring as complete a file of service records and neatly arrange the information for your prospective buyer. This will instill confidence that you took care of the vehicle.

- Be honest. Disclose any accidents, serious problems, or repairs to bring the vehicle to correct condition.

- Don’t be offended. It’s pretty common for prospective buyers to get the car checked out by a professional mechanic. The safest way to handle this step is to meet the prospective buyer at the mechanic’s location. Better yet, do this step before you start price negotiations.

- Allow room to negotiate. Set the asking price above what you really want to leave room for negotiation. And remember, just because you might think you “need” a certain amount of money from the sale is no reason to expect someone else to pay that amount. A car is worth only what someone will pay for it, on that day, at that time.

Quick Glance Trade vs. Sell

| TRADE | SELL YOURSELF | |

| Money | You may get less | You may get more |

| Speed | Quick | Indefinite |

| People you interact with | Dealership | Indefinite |

| Reconditioning | Dealership | Your responsibility |

| Paperwork | Dealership | Your responsibility |

9. Consider Your Buying Options

Moving to the seat behind the wheel of your next new car is the most exciting part of the buying experience. By this time, you narrowed your choices down to a few vehicles that are right for you and set goals for negotiating price, monthly payment, trade-in, and finance options. You can now get ready to negotiate and purchase your next new vehicle with confidence.

The traditional way of picking a dealer has evolved. Today, there are many options to approaching the retail car purchase. You have a great place to start if you have a good relationship with a trusted local dealer that offers the brand you’re looking for. Convenient internet tools come in many different types. For example, Kelley Blue Book can help you find the car you want, and with an accelerated deal format, connect you to finance offers, put you in touch with the dealership with that financing offer, and help get the car delivered to your doorstep.

You can also buy your car by:

Using the Dealer’s Website

Most dealerships during the COVID-19 pandemic updated how to transact with consumers. It’s possible to buy a vehicle entirely online and get it delivered to you. You can also transact at the dealership.

Visiting a Manufacturer’s Website

Manufacturers and dealers are adapting to new ways of doing business so consumers can purchase the cars they want. Tesla sells cars directly to consumers, with no third party involved.

For other manufacturers, it’s easier than ever to factory order the car you want in the color you want, with all the features you want, and then pick it up at a dealership. In some cases, they will deliver it straight to your door.

Most manufacturers have links to their websites via Kelley Blue Book’s Free Price Quote tool for your convenience. While economic conditions make it more challenging to find incentives, some manufacturers offer loyalty programs and other special promotional offers to customers who register directly through their sites. If available, check out the latest manufacturer incentives, including low finance rates, 0% percent deals, and customer cash.

Connecting to Direct Buying Sites

If you prefer to purchase your next vehicle from a direct buying site, these online companies will work with you to complete the entire transaction with the dealer — all the way to delivering the car to your front door.

10. Get the Most Out of Your Test Drive

So you’ve done your online research and located a dealer. Now you are ready to experience the vehicle first-hand. Once you’re a serious shopper, the dealer will work closely with you and provide full access to the vehicle for inspection and test driving. If you plan to test drive a few different vehicles, let the salesperson know that you are still gathering information to make your final decision.

A good salesperson will know about the vehicle’s finer points and make you aware of additional features you didn’t notice while doing your online research.

Kick the Tires

It’s important to get up-close and personal with your prospective new vehicle. Ask yourself these questions:

- How’s the overall appearance?

- Are there any unsightly gaps?

- Do the exterior and interior colors look good together?

- Is the trunk and cargo area spacious enough for your needs?

- Is the driver’s seat comfortable and easy to adjust?

- Are the controls easy to understand and use? Does the steering wheel feel good in your hands?

Determine what vehicle characteristics matter most to you. If music is your thing, make sure the sound system’s quality works to your satisfaction. If you plan to have frequent passengers in the back seat, climb in the back and buckle the seat belt for the full effect. How about convenience features like USB ports, cupholders, or sunglass holders? If you use them a lot, this is an excellent time to examine them closely.

The Test Drive

Now that you’ve completed a thorough walk-around, you can concentrate on the driving experience. The test drive can help you make your final decision. When you drive the vehicle, take your time. Be sure to drive on both city streets and the highway and never feel you need to rush the process.

Whether you are an expert driver or not, there are key areas to keep in mind during the test drive that will ultimately matter in the long run.

Ride Comfort

Is the ride smooth or uncomfortable? How does the driver’s seat feel while driving? Are there any unusual vibrations or jolts when you go over rough roads?

Noise

Do you hear excessive engine, traffic, or other noise coming through the car’s cockpit? Can you hear the wind coming through the windows? Or is there annoying road noise from the tires or squeaks and rattles?

Power and Acceleration

How does the vehicle respond when you push the accelerator pedal? Does it hesitate or lurch forward? Does the engine feel solid and smooth?

Braking

Does the vehicle come to a smooth stop when you apply the brakes? Do you feel any vibrations through the brake pedal? Is the steering affected by the braking? Does the car stop in a straight line?

Handling

Can you park the vehicle? Does it seem easy to maneuver? When you turn the wheel, does the car respond predictably? Is the turning radius tight enough to make a U-turn? Are there any blind spots that hinder visibility? Your driving experience should back up the homework you’ve already done. If not, you may want to revisit your selection.

Now that you’ve driven the car, you may finally be ready to make a solid purchase decision. Remember, your final decision will always include a certain amount of emotion. But the more homework you complete, the less emotional your actual purchase decision will be.

Drive Off

A good deal means different things to different people. With the help of Fair Purchase Prices, you can be confident that you will pay the best possible price. But remember, price isn’t everything. Knowing what you want to accomplish is the other half of the battle. Before you close the deal, ask yourself:

- Did I purchase a well-built vehicle that meets my needs?

- Is it at a price I can afford?

- Is the price I paid a good value for the money?

- Did I fully understand and feel comfortable with the entire transaction?

If you have accomplished all those points, you made a good deal.

After a thorough check of your new vehicle and completing the paperwork, you can drive your brand new car, pickup truck, SUV, or minivan home.

Read Related Car Buying Stories:

Editor’s Note: This article has been updated for accuracy since it was originally published.