Quick Facts About the Car Buying and Selling Marketplace

- New car prices are at their lowest point in almost two years.

- Used car prices rose slightly in March but remain 4% lower than they were a year ago.

- Interest rates are falling slowly, but significant improvements are likely later in 2024.

After two difficult years for car shoppers, the early part of 2024 has been filled with good news. What was once a seller’s market has turned decidedly in your favor.

If it weren’t for soaring car insurance prices and stubbornly high interest rates, we’d have nothing but good news. As it is, we have mostly good news. Except for the bits about insurance premiums and interest rates. We’ll get to those in a moment.

The quick headline on car shopping right now is that supplies are ample at many dealerships, and prices are on the way down in response. They may have further to fall. So you might benefit from waiting longer to buy a car if you can.

But if you must car shop this month, you’ll find a lot of good options and a negotiating environment that gives you some leverage.

We’ll walk you through what to expect while buying or selling a new or used car or trading one in. Many car shoppers are in both markets simultaneously, with a vehicle to swap. They’re likely to find balanced offers on their trade-in this month. Read on to find out more.

- What New Car Shoppers Can Expect

- What Used Car Shoppers Can Expect

- Automakers Are Building More Expensive Cars

- Older, Less Expensive Cars Harder To Find

- How To Buy a Car Right Now

- Selling a Car Right Now

- Trading in a Car Right Now

- Looking Ahead

- Tips for Buying a Vehicle Right Now

What New Car Shoppers Can Expect

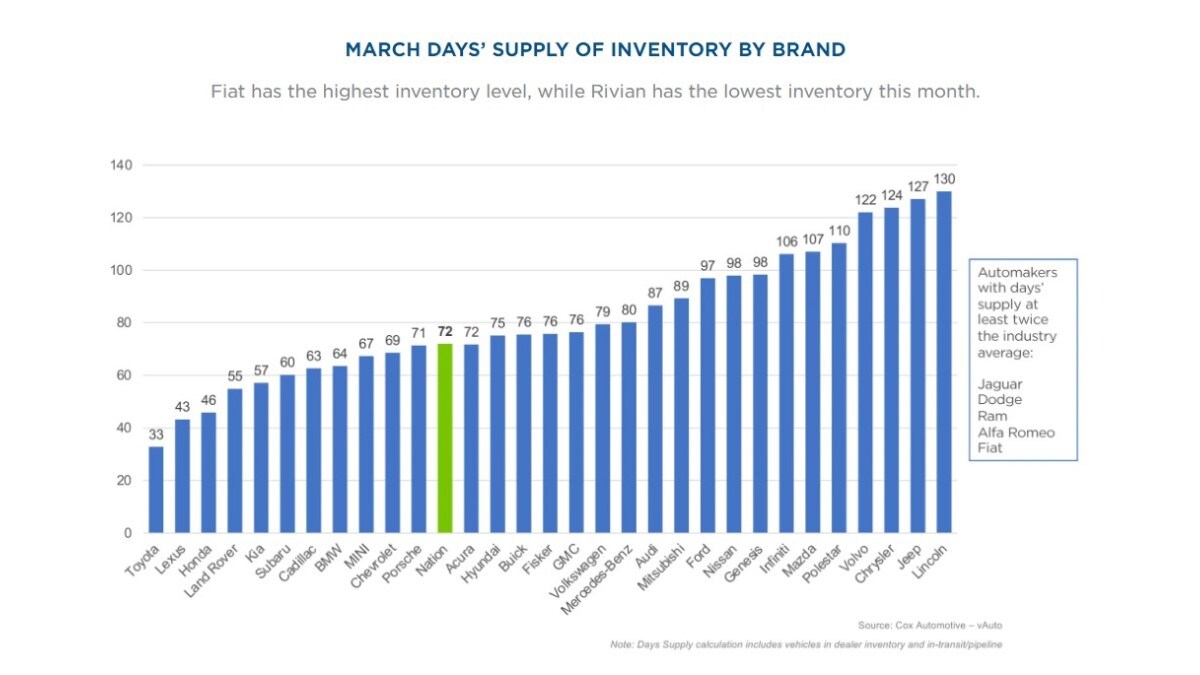

Car dealers traditionally aim to keep about 60 days’ worth of new cars in stock. Veteran salespeople say that a 60-day inventory is large enough that your local dealership probably has the combination of colors and features you want in stock.

Fewer means you might go elsewhere to find it. More is wasted money – car dealers generally don’t own the cars on their lots. They’re making payments on them just like you likely will be when you buy one. So, when they have too many cars in stock, they’re wasting money. That can lead them to discount cars to get rid of them.

The average car dealer started this month with a 72-day supply of new cars.

That’s pushing prices down. The average buyer paid $47,218 in March — nearly a 2-year low. Prices remain about 15.5% higher than in March of 2021. But they’re down 5.4% from their peak, which came in December of 2022.

With too many cars in stock, incentives are climbing. Discounts made up 6.6% of the average sale last month — more than double the numbers from a year ago.

RELATED: When Will New Car Prices Drop?

As the chart above shows you, the story isn’t the same at every dealership. Toyota, Lexus, Honda, Land Rover, and Kia dealers are actually a little understocked at the moment. You’re not likely to get a deal from them.

But most brands are overstocked, and a few unlucky brands have more than double the industry’s average inventory today. They’d be happy to see you and likely to make you a deal.

Two sour notes, however, should enter into your calculations.

One is that, while new car prices are coming down, car insurance premiums are rising. The cost of car insurance has grown so high in the last year that we now encourage shoppers to get insurance quotes on any car they’re considering before they put a dollar down. Insurance costs might make you consider a different car.

The other is that, while it’s easy to find a deal on a good car this month, it’s much harder to find a good car loan.

Interest Rates May Fall Later This Year

Shopping for a car right now is easy. Shopping for a loan is not. Interest rates are historically high.

The Federal Reserve – commonly called the “Fed” – sets the interest rate banks use when they loan each other money. That rate governs rates for every other kind of loan, including car loans.

The Fed raised rates last year to try to get control of inflation. They had announced plans to cut them this year. But, so far, they haven’t. Interest rates remain stubbornly high. Fed chair Jerome Powell recently cited the soaring cost of car insurance as one reason the bank hasn’t started cutting rates yet.

That’s limiting many shoppers’ options. Very few of us are cash buyers. Most Americans borrow money to pay for a new car. High interest rates are making borrowing a challenge.

On a positive note, cars are becoming slightly more affordable. The average earner would now need to work 37.1 weeks to pay off the average new car. That’s down from a high of 44 weeks in December 2022 and the lowest figure in more than two years. The average new car payment remains fairly high – $744. But it was $795 in December of 2022. Be glad you’re shopping now, not then.

What Used Car Shoppers Can Expect

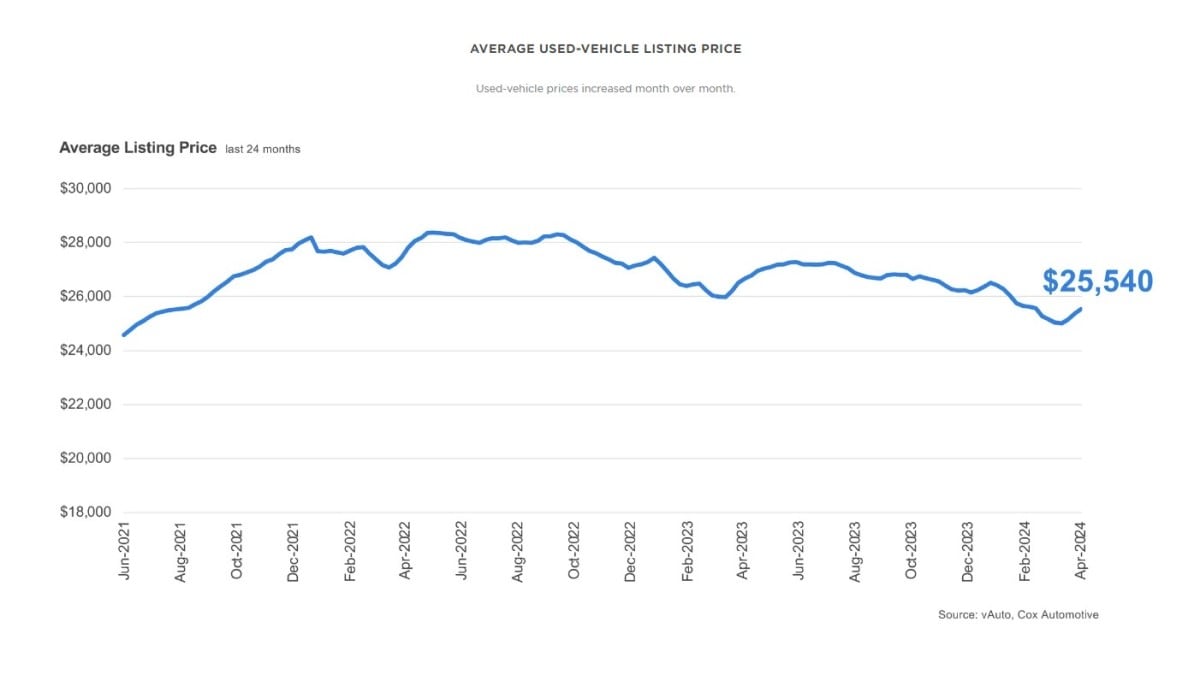

Car dealers listed the average used car for $25,540 at the end of March. That’s 4% lower than year ago. It shows a slight increase from February, but a mild increase is normal this time of year as tax return season sends millions of us shopping.

Used car prices have been in a slow, steady decline throughout 2024.

That’s unlikely to change soon, as the wholesale prices dealers pay for the used cars they put on their lots have been declining, too.

The nationwide used car supply will likely remain a little thin for years. The pandemic era disruptions meant automakers built about 8 million fewer cars than they otherwise would have in 2021 and 2022. That’s 8 million cars that will never reach the used market, keeping supplies low for a long time.

But it hasn’t mean unusually high prices.

The least-expensive used cars remain hard to find. Dealers ended March with just a 33-day supply of the older, higher-mileage used cars they price below $15,000.

Automakers Are Building More Expensive Cars

Though short-term trends are pushing new car prices down, automakers are focusing efforts on building more premium cars. The era of the inexpensive car is disappearing. A recent analysis finds that sales of cars priced at $25,000 or less have fallen by 78% in just five years. Five years ago, automakers offered 36 new models in that price range. This year, that number is just 10. Meanwhile, those priced at $60,000 or higher have grown by 163% during the same period.

Cox Automotive Chief Economist Jonathan Smoke explains that last year’s Federal Reserve interest rate hikes kept some shoppers from buying cars. “This trend induces automakers to focus on profitable products for consumers who can afford to buy, which keeps less affluent consumers out of the new-vehicle market altogether and limits what is available and possible in the used market for years to come,” Smoke cautions. Cox Automotive is the parent of Kelley Blue Book

Dealers are pushing back, telling automakers they need more affordable cars to sell. But correcting the problem will take time. You’ll likely find affordable cars in short supply on many sales lots.

Older, Less Expensive Cars Harder To Find

If you hope to find an older vehicle and your budget is less than $15,000, these cars remain in short supply. More would-be new car shoppers started buying up the available used vehicles, drawing down the inventory. Plus, Americans are holding onto their cars longer than ever. The average vehicle on American roads is now 12.5 years old. Automakers also produced fewer cars for several years after the 2008 recession, leaving fewer higher-mileage, older used vehicles available to sell.

The most accessible used cars are priced between $15,000 and $30,000.

How to Buy a Car Right Now

If you want a new or used vehicle, be prepared for sticker shock. For new cars, prices remain about 15.5% higher. At that time, average transaction prices for new vehicles were around $40,000. But take stock that your next car will likely last longer and help you drive safer than ever with all the technological advances and offerings.

RELATED: Buying Older, Used Cars in 2024

Vehicle quality studies repeatedly show that today’s new cars suffer fewer problems than those from just a few years earlier. Buyers of higher-priced used cars will likely see the vehicle driving on the road even longer. The same goes for those buying new ones.

With most automakers now building such durable cars, they compete by adding more high-tech features. Features like adaptive cruise control and Apple CarPlay are now more common than ever on entry-level vehicles. Read on to see our tips on buying a car below.

How to Leverage Incentives to Buy a New Car

Car incentives made up 6.6% of the average deal in March. To take advantage of incentives, read about our monthly best car deals to find dealer or manufacturer incentives, including cash back and lower interest rates for financing your next vehicle.

RELATED: How to Buy a New Car in 10 Steps

Selling a Car Right Now

Few of us can sell a car without needing to buy a replacement. But, if that’s you, what are you waiting for? You will likely get more for your vehicle, and that’s excellent news. The best way to get the most money for your used car is to sell it privately. But if you don’t want the hassle, there is still an opportunity to sell to a dealership.

PRO TIP: If selling a car, consider selling it peer-to-peer using Kelley Blue Book’s Private Seller Exchange marketplace. It’s a low-cost method that helps consumers earn more for their vehicle than selling to a dealership.

Trading in a Car Now

Falling used car prices mean a little less for your trade-in, but the ongoing shortage of used cars will be with us for years. You’ll still likely see respectable offers for your used car this month.

“Fewer new vehicles produced in 2021 meant lower leasing, which equals fewer lease maturities starting this year,” said Jeremy Robb, senior director of Economic and Industry Insights at Cox Automotive. “After being low for the last two years, used-vehicle supply is expected to improve later in 2024 — but that will be without much help from off-lease supply.”

Searching for a decent price for your trade-in is still a good idea by shopping it around. Each dealership tries to keep a balance of vehicles on its lot. Sometimes, the one you want to buy from doesn’t need your trade-in desperately, but a competitor does.

Research your vehicle’s Kelley Blue Book value, then call several local dealerships to see what they’ll offer you for it. Or try our Instant Cash Offer tool, which brings the deal to you from various dealerships without obligation. You can choose your preferred offer or use it to negotiate with others.

Looking Ahead

According to the Cox Automotive/Moody’s Analytics Vehicle Affordability Index, new vehicle affordability improved throughout last year. That trend is continuing so far in 2024.

However, car shoppers can expect the second half of 2024 to look better since any interest rate cut could help affordability. Easing inflation could relieve car buyers if the Federal Reserve lowers rates this year.

RELATED: 10 Best Used Car Deals

Tips for Buying a Vehicle Right Now

If you shop right now, we recommend a few strategies to help you find the right new or used car that fits your budget.

- Expand your search. Widen your search to a broader geographic area.

- Stay patient. Call dealerships early and often to see what’s coming off the trucks for those harder-to-find vehicles. Leave a refundable deposit if you want first dibs.

- Buy a less expensive model. With higher car loan interest rates, consider buying a cheaper vehicle model instead of a more expensive one in the lineup you’re considering.

- Understand the timing. Be prepared to shop for several weeks, and know it involves calling or visiting several dealerships as you look for the right fit.

- Don’t jump. Shop around your trade-in as aggressively as you seek out the right car. Don’t accept the first offer. You could sell yourself short.

- Weigh your options. Don’t just look for a car; search for the best interest rates from banks or credit unions. Then, weigh all your options, including financing incentives and deals at the dealership, if that’s where you buy your next vehicle. Also, you may find the price differences of some newer model used vehicles are almost the same as new cars. Just keep all your options open during your search.

- Don’t pay dealer markups. If you see a markup, sometimes called a market adjustment, on your final invoice, ask that it be removed or shop at another dealership.

- Question all add-ons. If your sales summary includes entries like “window tint” or “fabric protection” and other add-ons you didn’t request, ask for those line items to be removed from your invoice. Many dealers tack on these extras to make quick profits.

It may make sense to keep your existing car for another year. If you must buy, be prepared to take excellent care of your next car to keep it running for a long time.

Related Articles About Car Buying and Selling:

- Buying a New Car During the Chip Shortage: What You Need to Know

- 7 Ways to Help Protect Yourself When Selling a Car

- How to Sell a Car Online

- Recalls 101: What You Need To Know To Stay Safe

This article has been updated since it was initially published.